The numbers were particularly strong, well above consensus for both the current and guided quarters.

Solid execution and some strong tailwinds are helping.

With that said, we saw things we both liked and disliked in their numbers.

Critically, they noted this rate increase applies to architectural licenses as well.

The company said three companies converted from their AFA plan to the ATA model.

They have spent a few years putting these programs in place and seem to have thought them through.

This matters particularly because these programs are well suited for smaller, earlier-stage companies.

Programs like AFA and ATA could go a long way to redressing those past wrongs.

Arm China is a constant source ofspeculation.

Investors are confused, too.

Some of this is tied to AI, but we think the story is broader than that.

The AI story is largely about GPUs, which are not particularly heavy with Arm cores.

But those GPUs still need some CPU attach, and AI accelerators can sometimes be good Arm targets.

When asked about segmentation of their results the company declined to update the model provided during the IPO.

We hope to see some diversification here when they do update their figures later in the year.

Overall, the company did a good job in the quarter.

And, that leaves bring up the question of valuation…

Arm is now worth $130+ billion and trades at 2025 P/E of 100x.

These are lofty numbers.

And while earnings were solid, the jump in the stock was considerably higher than the numbers alone justify.

So the jump in the stock is in no small part attributable to an ugly short squeeze.

Roughly 25% of Arm’s stock floats, the rest is held by parent Softbank.

We have to imagine that a secondary offering for more of Softbank’s shares is already in the works.

The question is, can Arm ever grow into this valuation?

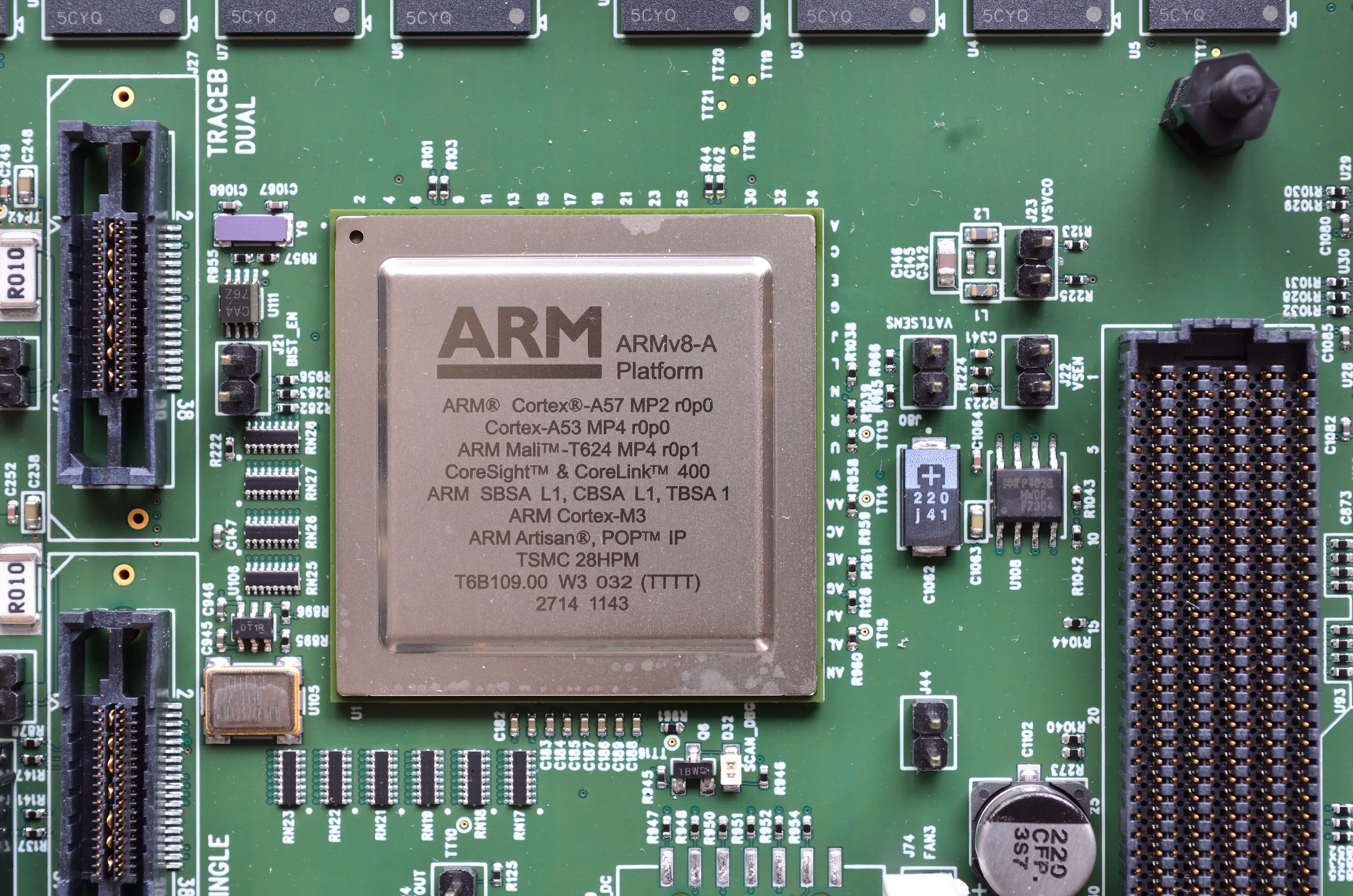

This question sits at the root of all those sell-side questions about the v8 to v9 transition.