This allows them to raise prices as high as they want.

Let’s use an example.

Imagine a sizable TSMC customer not in the Top 3, but maybe in the Top 10.

They likely pay TSMC $20,000 per wafer today, with lower-volume customers paying closer to $25,000.

Let’s say this company has a chip that is 170 mm2.

Now suppose TSMC raises its price to this customer to $40,000 for its next process.

The cost per chip, however, jumps to $107.

This is the heart of the Moore’s Law slowdown density increases now greatly lag price increases.

The hardest hit will be customers with smaller volumes, spanning from start-ups to hyperscalers.

For many, Moore’s Law becomes extremely challenging.

The fact that they haven’t suggests they won’t in the future.

However, conditions are changing.

Until recently, a cautious and paranoid TSMC needed to worry about Intel or Samsung becoming competitive again.

That now seems increasingly unlikely.

And this is why Intel Foundry matters.

But look ahead a few years, to a world where TSMC can freely raise prices.

In that scenario, everyone will be desperately searching for an alternative.

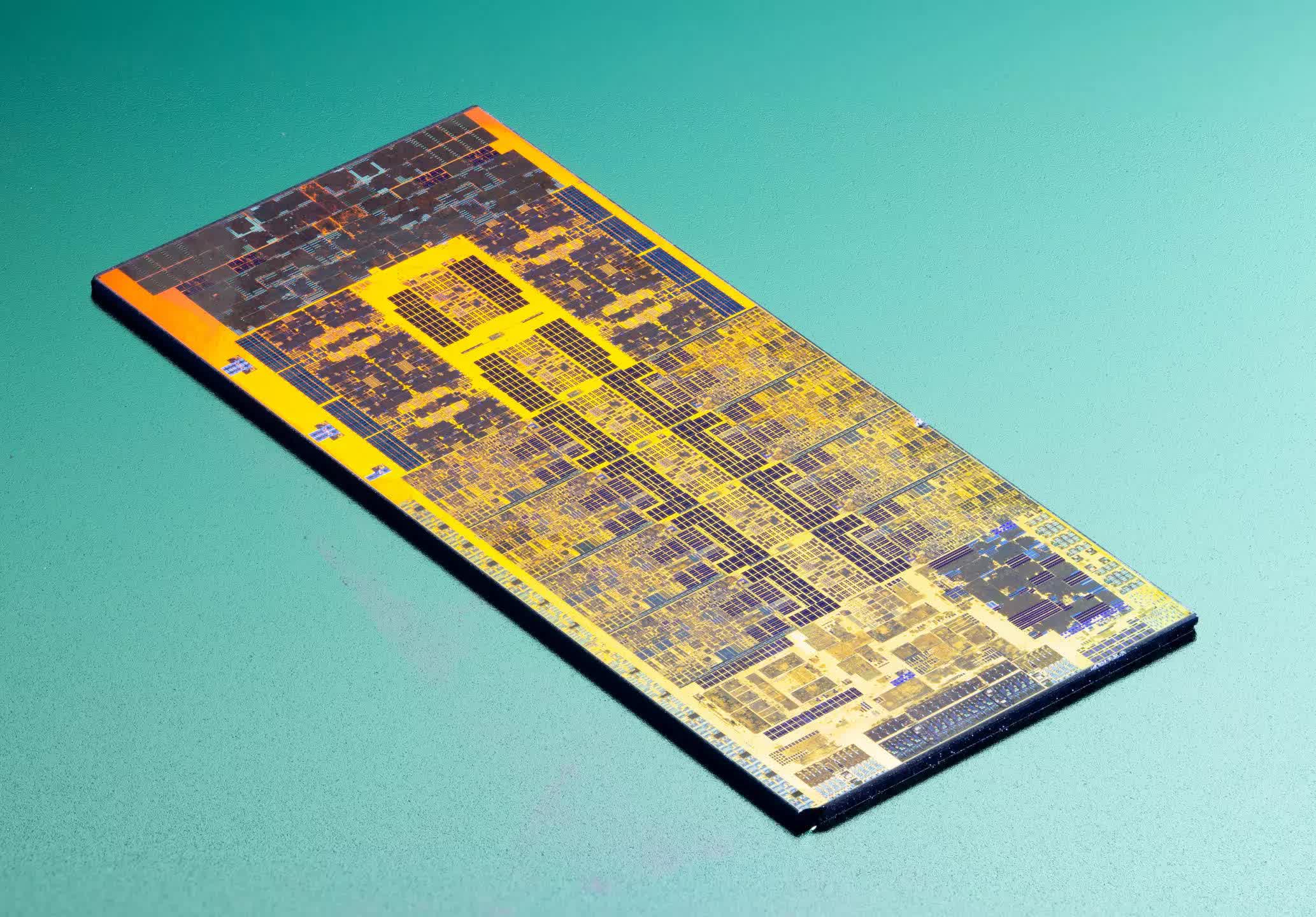

Masthead credit:Fritzchen Fritz